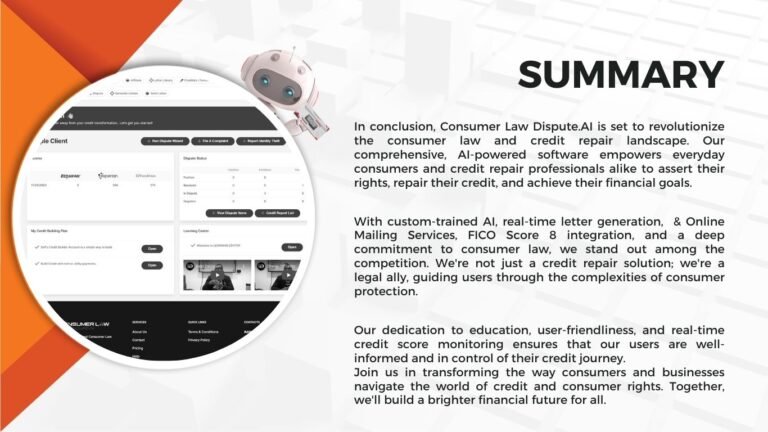

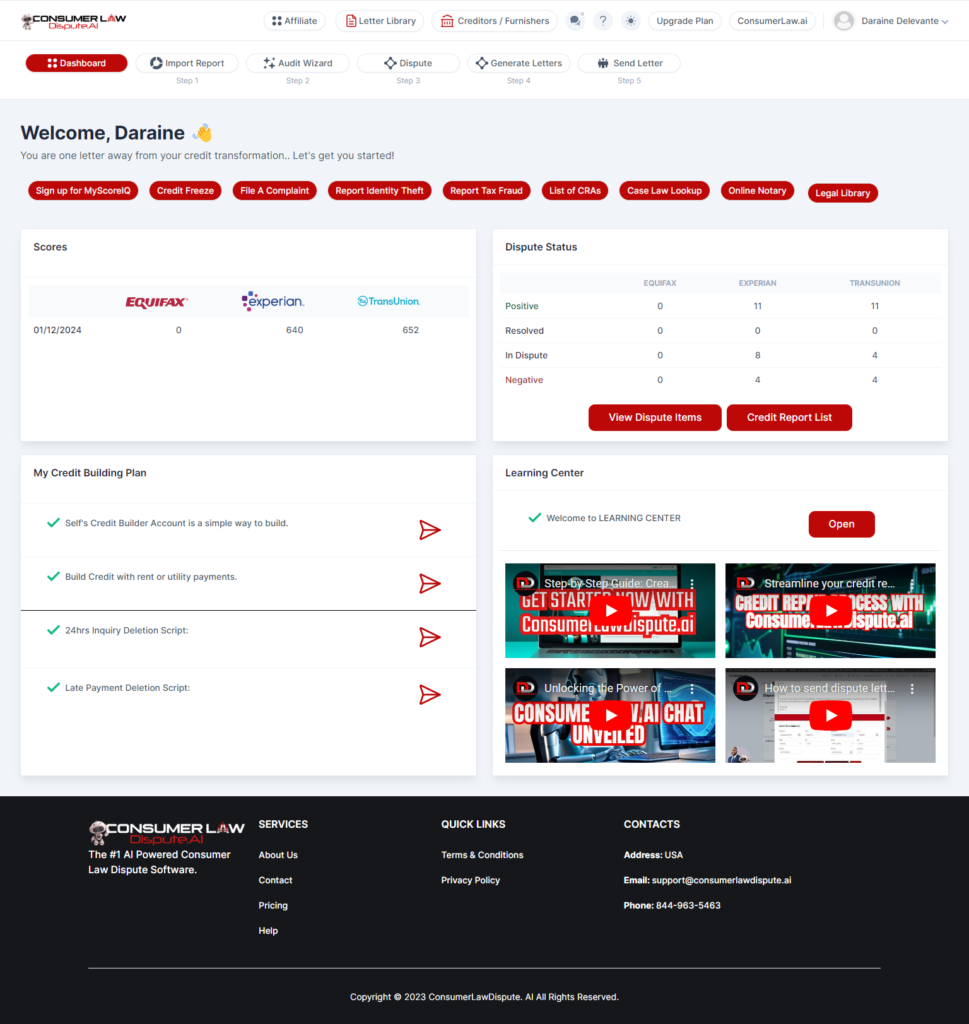

Elle Media Empire collaborated with Consumer Law Secrets LLC to develop Consumer Law Dispute.ai, the first AI-powered software designed to simplify consumer law disputes and credit repair. This case study delves into the technological innovations, user-centric design, comprehensive features, and launch strategies that make Consumer Law Dispute.ai a revolutionary platform in the consumer law and credit repair industry.

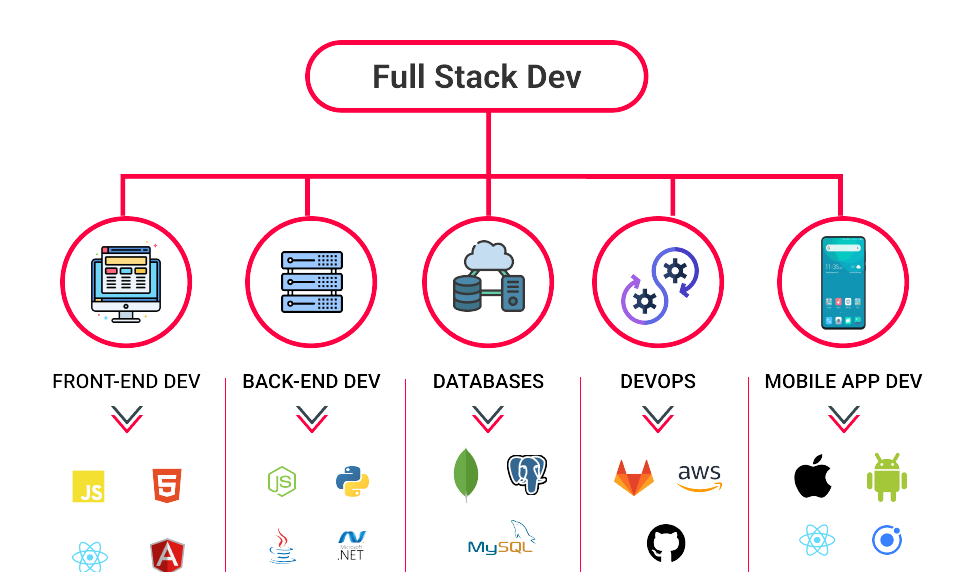

Elle Media Empire tackled these challenges by leveraging their expertise in technology and business strategy. The project involved the following key steps:

User-Centric Design

AI and Gen-AI Integration

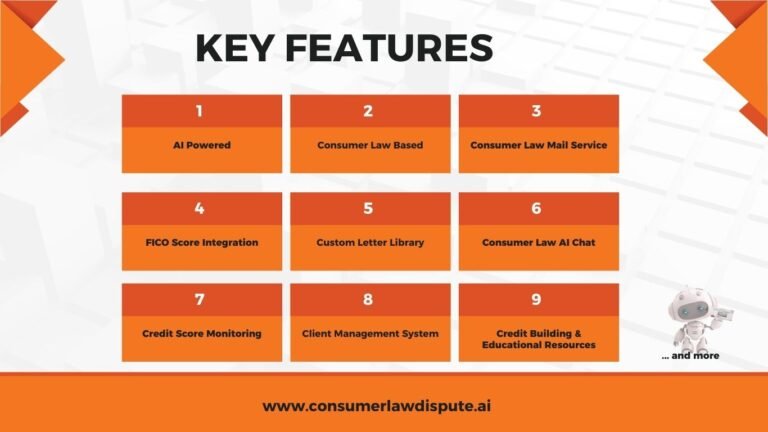

Comprehensive CRM Features

Effortless Dispute Process